Rating:

Quicken Mac, free quicken mac software downloads. Got a Mac?Then download Smiling Bubbles and try to cope with the funny bubble-faces that sometimes behave so unpredictably and just strive to make some cute trick.Match them up by their appearances and win the game! Review of Quicken Software: system overview, features, price and cost information. Get free demos and compare to similar programs. Quicken's investment tool allows users to look up security symbols within the system and enables the automatic download of option prices and history. Quicken, bring Home and Business to Mac. Also, allow the.

While a step up from previous versions, Quicken 2019 for Mac still falls short of the gold standard, Quicken for Windows. The addition of a web-based platform is a welcome addition. For some, Quicken for Mac might be a usable native MacOS personal finance app.

Rating:

- Investors

- Retirement savers

- DIYers

- Desktop users

One of the biggest news items in the personal finance software space for 2015 was the releasing a new version of Quicken for Mac. The last time there was a true update for Quicken for Mac was in 2007. Quicken Essentials for Mac was released after that, but no one really takes that app seriously.

Previously, for Mac users who liked using Quicken, it was necessary to run VMware Fusion and use the Windows version. For the most part, when Intuit owned Quicken it was ignoring the Mac platform, and that resulted in problems for Mac users who want to use Quicken.

Now with four years under their belt, they just released the latest version — Quicken 2019 for Mac. This is the second version of Quicken as an independent company and no longer part of Intuit. It should be made known that Intuit has sold the Quicken product line to H.I.G. Capital. Quicken has promised to keep improving the Macintosh version and the latest version has kept this promise.

Quicken for Mac Features

| Price | $34.99 - $74.99/year |

|---|---|

| Budgeting | |

| Bill Payment | |

| Investment Tracking | |

| Access | Macintosh, iOS App, Android App |

| Credit Score Monitoring | |

| Bill Management | |

| Retirement Planning | |

| Tax Reporting | |

| Reconcile Transactions | |

| Currency Support | Multiple |

| Custom Categories | |

| Two-Factor Authentication | |

| Import QFX, QIF Files | |

| Online Synchronization | |

| Promotions | Save on Quicken for Mac |

What’s New for Quicken 2019?

Last year, the big buzz was Quicken’s adoption of the subscription model. This year, the big headline is Quicken’s introduction of a web-based platform.

This is something Quicken Mac users have been asking for for a while. With the web platform, you can now access your data along with many features of the software from wherever you have internet access. The data is stored in the cloud and will sync with what’s on your desktop app.

However, the web platform is still just a companion to the desktop version. You still need to download and set up a desktop account. The web platform is best for quick check-ins with your Quicken for Mac account, while still doing most of the heavy lifting with the original software.

Quicken 2017 for Mac New Features

- Manage your Investments — See how your investments are performing. Track cost basis, see realized and unrealized gains, and capital gains.

- Better Reporting — Compare your income and spending with custom reports.

- Improved Mobile App — Do more on the go with more functionality added.

- Improved User Interface — Enjoy a new look that’s easier to use and navigate.

Compared to the previous update in 2016, this one is a bigger improvement. In fact, Quicken has made the functionality more like its Windows counterpart (finally). Some individuals have commented they can finally get rid of the VMware Fusion version of Quicken for Windows and run Quicken natively in MacOS. For me personally, I still prefer running the Quicken for Windows as the investment section (though much improved in this Mac version) and a few other features are still not up to par on the Macintosh version.

To run Quicken for Mac, you’ll need to be running OS X 10.10 (Yosemite) or newer.

New Features introduced in Quicken 2016 for Mac

If you missed last year’s version of Quicken for Mac, here’s what was available in the previous release:

- Bill Payment — You can make payments within the Quicken app.

- Ability to transfer money between bank accounts — If set up within Quicken, you can transfer monies between accounts.

- Free Phone Support — Phone support is available Monday to Friday, 5 AM to 5 PM PST, and you can use their online chat support 24/7.

Quicken for Mac Alternatives

| Personal Finance | |||

|---|---|---|---|

| Rating | 8/10 | 8/10 | 7.5/10 |

| Budgeting | Yes | Yes | Yes |

| Investment Monitoring | Yes | Yes | Yes |

| Promotions | Save on Quicken for Mac | 10% Off of Banktivity | First 100 Transactions are Free |

| Visit | Moneydance Read the Review |

File Conversion Process

If you are currently running Quicken for Windows via VMWare Fusion, it might be possible to convert your setup to Quicken for Mac. One of the improvements in Quicken 2016 was the conversion of multiple older versions of Quicken.

Specifically, there is full support to move from Quicken for Windows (2010 or greater) or the 2007 version of Quicken for Mac. In my real-world test, with over 70 accounts and over five years of transactions I was able to convert from my Windows data file without issue. I assume Quicken tested this feature quite a bit, since most users of their service are already using Quicken in some form. Unfortunately, passwords are not transferred and you must re-enter them into Quicken for Mac. Otherwise, the process was painless.

Quicken for Mac vs. Quicken for Windows

Be aware Quicken 2019 for Mac does not function exactly the same as its Windows counterpart. In some ways, this is good, because Quicken can take advantage of features available only in Apple’s MacOS operating system. On the other hand, Quicken for Mac operates slightly different than the Windows counterpart. For someone like me who’s very familiar with the Windows version, it was sometimes hard to find various features.

The Windows version is still Quicken’s primary platform and gets all of the latest bells and whistles. Quicken for Mac is missing these features:

- Debt Reduction Planner

- Loan Amortization

- Customizable Portfolio View

- Investment Reports, IRR, ROI

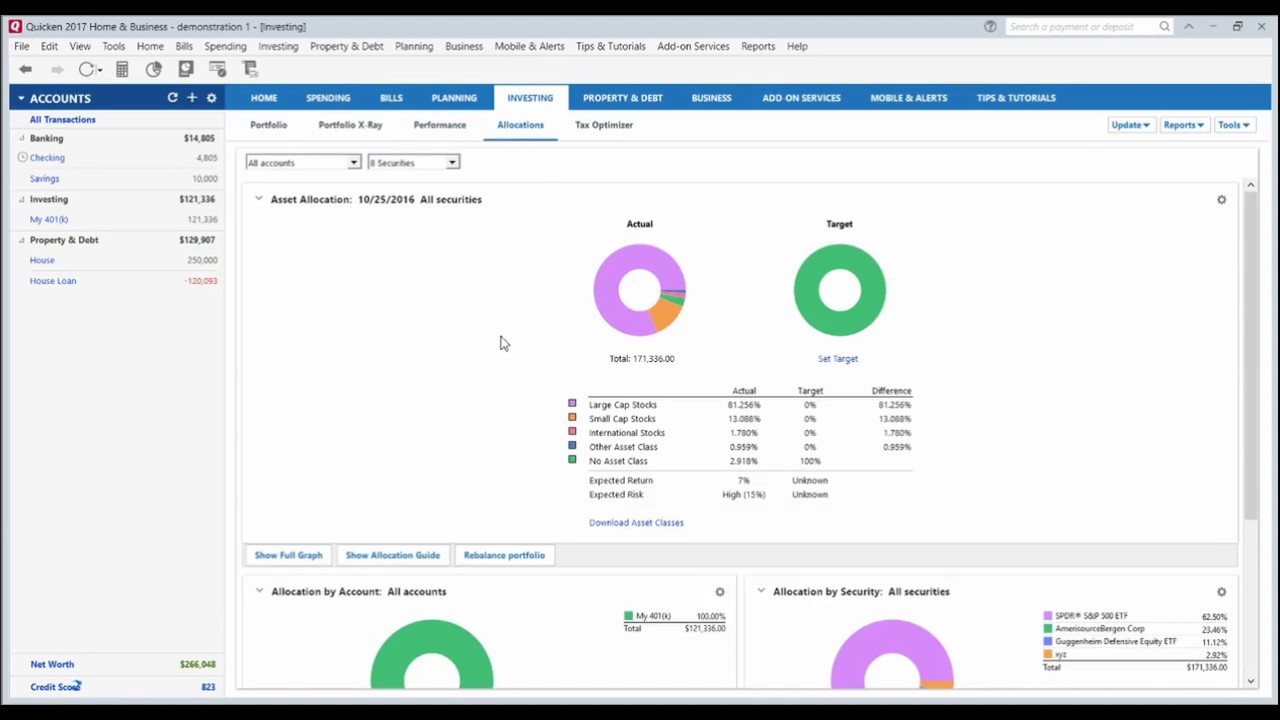

- Investment Allocation View

- Profit & Loss / Balance Sheet Report

- Automatically Link Online Bills to Display Due Date and Amount Due

- Free Credit Report

- Portfolio X-Ray

- Multiple Currency Support

- Automatic Backup (though you should be using Time Machine for backups anyway)

- Automatic Reconciliation

- No Paystub tracking

For some users, these missing features make Quicken for Mac a non-starter.

One major sticking point with me is their investment reporting isn’t as flexible as the Windows version. For someone like me who likes to track my investments in detail, this is a deal breaker, though it’s better than Banktivity’s investment section. Quicken for Mac is currently the best investment monitoring tool on the market… for a Macintosh. Though that’s not saying much. I prefer the online tool Personal Capital reporting for my investment portfolio.

For some, the lack of investing functionality might not be a significant issue and their primary use is for budgeting. I suspect these users will like Quicken 2019 for Mac.

Testing

As I just mentioned, Quicken for Mac is a native application and is built to take advantage of the MacOS interface. As a result, the redesign is sleek and attractive. It’s also easy to navigate, and the account setup process is fairly straightforward. Intuit supports over 14,500 financial institutions for downloading accounts and will remain available with the new owners of Quicken.

On top of that, there is mobile syncing, so you can sync up your information between your mobile device and your desktop. This is a convenient way to manage your finances if you use Quicken for Mac. This mobile app is free to download and is available for Apple’s iOS and Google Android devices.

Another new development, when compared to Quicken Essentials, is the ability to track your investments.

The navigation is simple so you can easily add or delete transactions. It’s also got an easy-to-use reconcile function, much like what was available in earlier versions. Many people overlook the ability to reconcile your accounts, but we like it, because it reminds you to make sure that your records match what your bank has and helps you identify problems in reporting. Using the reconcile feature is a very important feature for anyone serious about managing their finances.

Another nice touch is that Quicken for Mac makes it easy to analyze your finances. The new interface means the display is easy to read and understand, and graphs and charts make it easy to see exactly what is happening with your money.

You can choose to look at it in terms of monthly, quarterly, year-to-date, or other time periods. One of the biggest issues I had, when I imported my data from my bank, was that a number of items were not categorized. So, I had to manually begin categorizing what wasn’t evident to the system. Actually getting the information into the program wasn’t that difficult. I had to download a file from my bank and then drop it into Quicken, but it was easy to do with drag and drop.

However, updating the uncategorized items can be tedious, and I’ve heard stories that other data imports didn’t go very well, so be prepared for that. As you can see, I didn’t finish changing all of my categories. But the quick overview of my spending was appreciated. I also like that it’s possible to see reports of cash flow, although I don’t like the layout as much as I like the way Moneydance presents the information.

It’s also possible to see your spending over time and compare how you are doing in terms of cost cutting. You can also set up savings goals to follow, but it’s not possible to create long-term life goals. For me, this isn’t a big deal, since I don’t use such tools in my personal finance software. However, for those who like to use their personal finance software for long-term planning, Quicken 2017 for Mac may not be the best option.

Another issue is the lack of bill reminders in calendar form. You can set up a bill reminder, but you can’t view your upcoming bills in calendar format, which makes it harder for many to be interested in this application. It’s a small thing, but it’s convenient for many to be able to see things laid out in a calendar format.

Additionally, there is no paycheck tracking ability with the new Quicken for Mac, so if you have been using Quicken on Windows to track income, along with deductions, you might be disappointed. And even though the interface is sleek and easy to use, the reports and graphs aren’t as customizable, and there is some functionality lacking.

Pros and Cons

Pros

- Bill Payment — Now available in the Mac version.

- Native MacOS App — Quicken for Mac is built from scratch for the Apple Macintosh which allows the software to fully utilitize the features within MacOS.

- Easy Conversion Process — If you are converting from other versions of Quicken, the process is pretty painless.

Cons

- Missing Features — Mac version lacks some important features compared to its Windows sibling.

- Weak Investment Tracking — While it has the most features of any other personal finance app for the Mac, there are better Windows tools and online services.

- Expensive — It is expensive compared to other personal finance software available for Macintosh.

Summary

Quicken 2019 for Mac adds some new improvements that might actually sway Mac users of other personal finance software to give Quicken a try. Though it is still not as feature-rich as its Windows counterpart.

The primary motivator for using this version is the Bill Pay feature. It is great they added this feature, but it should have been in the 2015 version. Because of this new feature, we increased the score for this version of the product to the new ranking of 8.5 stars.

During Intuit’s multi-year lapse of updates, many frustrated users switched to other alternatives to Quicken. The new owners of Quicken have stated they are committed to the Macintosh platform, so expect future updates and quicker bug fixes. If you have already converted to something else, like Banktivity or Moneydance, it might not be worth the hassle to switch back.

We feel that even with the new owners of Quicken there are better alternatives out there and still recommend Personal Capital as the best personal finance app.

Quicken 2019 for Mac isn’t a bad choice for new users looking for a native and local MacOS app. It does what it needs to do and will satisfy the needs of many users, though it’s still lacking some of the features many Quicken for Windows users are accustomed to.

Miranda Marquit contributed to the article.

Want to replace Quicken? We’ve got you covered.

As the granddaddy of personal finance software, Quicken was once the best money management tool on the market. Heck, it was practically the only tool on the market.

Now? Not so much.

Though it was all the rage back in the day, little has been done over the last few years to improve Quicken. In fact, Intuit (famous for programs like Quickbooks and Turbo Tax) actually sold off their ownership rights to Quicken back in 2016. Since then, rumors have swirled that Quicken will actually shut down its program for good.

Quicken 2018 Home And Business

Luckily, Quicken is not your only choice for personal finance software. These days, there are a number of alternatives that can help you manage your money as well as Quicken ever did…and for less money. In fact, some of the best Quicken alternatives are actually free!

So, if you’re looking for a new program to manage your money, you’re in the right place. Check out our list of the top 10 Quicken alternatives below.

Table of Contents

- 16 Best Alternatives to Quicken

Our Top Picks

Personal Capital [Editor’s Choice] – Personal Capital is our Editor’s Choice for Quicken alternatives. This free software automatically tracks your savings, spending, investments, net worth, and more. It’s easy to use and the free price tag makes it an excellent replacement for Quicken. We’ve used it for years and think you’ll love it too! Read the review | Learn more

Tiller – If you’re looking for a budgeting tool that also runs some basic financial reports, Tiller is it. This program takes spreadsheet budgeting to the next level by helping you create a monthly budget and automatically tracking your results. When it comes to tax prep, Tiller can also run detailed reports on itemized deductions, your annual spend by category, and more. Start with one of their templates, customize it to meet your needs, or build your own. Get it free for the first month, then it’s only about $5 a month. Read the review | Learn more

16 Best Alternatives to Quicken

1. Personal Capital

Personal Capital is our favorite money management software of all time. We’ve used it personally for years, and we continue to be amazed by this powerful software.

What’s so great about Personal Capital? For starters, it’s free.

That’s pretty awesome considering they offer a comprehensive collection of money tools in one convenient place. Here, you can track your spending, net worth, and investments. You can also use it to check your investments for expensive fees and calculate whether you’re saving enough for retirement. These tools are all 100% free and at your disposal after a simple sign up process.

So, how does it work?

In short, Personal Capital synthesizes the data from all your accounts and delivers a complete financial picture that’s easy to understand.

Just link Personal Capital to your bank, credit, and investment accounts and let the program do the heavy lifting. It imports your transactions and calculates how your spending aligns with your budget.

Unlike some other alternatives to Quicken, Personal Capital is more than just budgets. And, since it is free, it makes a great compliment to some of the other programs as well.

Personal Capital also offers a powerful investment management tool. It tracks your asset allocation, monitors your investment performance, and analyzes your fees. It even takes your retirement goals into account and estimates your retirement income/expenditures based on your financial data. And, of course, Personal Capital also calculates the value of your assets relative to your debt (i.e. your net worth).

It might sound like a lot going on, but the app is incredibly user-friendly. A summary of your financial situation is available on the dashboard as soon as you open the app.

With all these money tools being offered for free, you might be wondering how Personal Capital actually makes money. Good question. They also offer fee-based wealth management services. Those are entirely optional, and you’re in no way obligated to subscribe. Tons of users enjoy the free suite of tools without using the wealth management services.

In my opinion, Personal Capital offers the best free money management software on the market. With a robust collection of money tools and a free price tag, this program blows many of the other alternatives to Quicken out of the water. Check out our complete Personal Capital review for more information!

2. Tiller

Tilleris a relative newcomer as a money management software program. This financial tracking tool is used in conjunction with Google Sheets (Gmail account required). So, if you’re into spreadsheets, Tiller might be just your thing.

Although it started out as solution for budgeting, Tiller has become more than just a budgeting program. Tiller can help you prepare for tax season by running detailed reports on your itemized deductions, annual spending by category, and more. For self-employed people and freelancers, they also offer a nifty tool that helps you determine your estimated quarterly taxes. They also provide a debt snowball worksheet and some simple net worth tracking.

To get started, simply link your bank accounts to the program. Then, Tiller will automatically download your financial transactions into Google Sheets on a daily basis.

From there, you’re free to take advantage of Tiller’s limitless customization options. They provide multiple budgeting templates you can use, but you can also create a brand new spreadsheet unique to your preferences.

Quicken Home And Business For Mac Free Download Version

Every day, Tiller emails you a summary of your financial activity so you always know exactly what’s happening with your money.

You can try Tiller free for 30 days to see if it meets your needs. After that, it’s about $5 a month, or free for a year if you’re a student.

3. YNAB

You Need a Budget (YNAB) is an excellent choice for anyone who wants an easy to use and effective budgeting app.

YNAB doesn’t offer a whole suite of money tools like Personal Capital. It focuses on two things: building a realistic budget and tracking your spending. And that’s ok, because it does them both very well.

I say a realistic budget because YNAB’s philosophy is that a budget is fluid and should be adjusted frequently in response to what’s going on in our lives. That’s why YNAB makes it so easy to move money between spending categories to keep your budget balanced.

For example, if you’ve budgeted $300 for groceries, but your transactions indicate that you’ve spent $340, YNAB will notify you that you’ve overspent and prompt you to deduct that $40 from another category. This system is especially useful if your goal is to maintain a zero-sum budget.

When you use YNAB, you have two choices. You can either automatically import your transactions by connecting to your bank and credit providers, or you can enter your transactions manually. Obviously, automating things is easier, but some may appreciate the option to do things the old-fashioned way.

YNAB offers a free 34-day trial, so you can try a full month of budgeting with no commitment. After that, the cost is $6.99 a month, billed annually. That means once a year, you’ll pay $83.88 to use the app/software. Unless you’re a student – then you can enjoy 12 months for free – which is a pretty cool benefit.

Also cool is that YNAB offers a 100% money-back guarantee. So, if you buy the app and decide it’s not helping you take control of your finances, YNAB will give you a full refund. Can’t argue with that!

4. Mint

Mint is a comprehensive financial tool that Quicken enthusiasts will probably appreciate. In fact, Intuit acquired Mint in 2010 shortly before they dropped Quicken from their suite of financial tools. Stew on that for a minute and think about which program Intuit thinks is better 🙂

Like with some of the other Quicken alternatives, when you link your financial accounts to Mint, you have access to your whole financial picture in one place.

As we mention in our full Mint review, you can build a budget, track your spending, monitor your investments, and manage your bills. The bills feature is really nice for people who haven’t automated their bill payments and want the ease of managing them on one platform.

Mint also lets you check your credit score and explains how it’s calculated. I think this is pretty neat because a lot of people don’t know their credit score or understand how these scores work.

With all that under one roof, you might be surprised to learn that Mint is free. Hey, we’ll take it.

5. PocketSmith

If you want to get a better handle on your money, PocketSmith might be for you. Like several of the best alternatives to Quicken, this program provides a strong option for budgeting. Where it really shines, however, is with its financial forecasting.

Instead of simply tracking what you’ve already spent, PocketSmith also helps you see what the future holds for your money. The “budget calendar” provides a daily look at your future income and expenses, all on an easy-to-read calendar so you can plan appropriately. Using your current info, you can even project your bank account balances as far out as 30 years into the future.

Our favorite feature is the “what if” scenarios. This feature allows you to test different spending and saving decisions and see how they affect your future financial growth. Wondering how reducing your grocery spending will affect your savings rate? Want to take a $2,000 vacation next summer? Use the “what if” feature to understand both the short-term and long-term consequences.

As with most Quicken alternatives, PocketSmith utilizes live bank feeds to update your transactions automatically. Over 10,000 different financial institutions are supported, so it’s pretty likely that you’ll be able to connect your accounts.

The basic functions of PocketSmith can be used for free, however you are limited to connecting just 2 accounts and 6-months of projections. The Premium version runs $9.95 per month and comes with 10 accounts and 10 years of projections. Unlimited accounts and 30 years of projections are available with the “Super” account which runs $19.95 per month.

Download mp3 to ipod touch without itunes. It’s an all-in-one iTunes alternative that effortlessly and quickly transfer music to iPod including other iOS devices.

6. CountAbout

CountAbout web-based personal finance software is another contender for the best Quicken alternatives. This program actually supports importing data from both Quicken and Mint, which is nice.

When you use CountAbout on a computer, there’s no app to install; you simply log in to their website. They do offer a mobile app for iOS and Android, but not all the features are available through the app.

Use CountAbout to create a customizable budget; then, sync it to your bank account to automatically import your transactions and track your spending. You can get a snapshot of your financial activity with widgets, or general full financial reports.

CountAbout offers two membership options: basic for $9.99 a year or premium for $39.99 a year. The only difference between the two is that the basic membership does not support syncing with online bank accounts. That means if you opt for the basic membership, your transactions will not be automatically downloaded. Your options are to enter transactions manually or import QIF files from your bank if they make those available.

If you’d like to try CountAbout before committing, you can get their 15-day free premium trial.

7. Moneydance

Moneydance is another viable personal finance software alternative to Quicken. In fact, if you currently have Quicken data, you can import it into Moneydance. It’s available as a desktop app for all the major operating systems and as a mobile app.

Moneydance’s interface kind of resembles a check register, where you see a record of all your transactions. Those transactions can be imported automatically by syncing with your online banking, or you can enter them manually. If you choose the automated route, you can also manage bill payments through Moneydance.

Of course, it wouldn’t be personal finance software without the ability to create a budget. Moneydance lets you create spending categories and track your expenditures. If you’re a visual person, you’ll appreciate the interactive graphing tool. You can also use Moneydance to track your investments and monitor stock performance.

If you’re technologically inclined (i.e. a tech nerd), you can actually develop extensions for Moneydance using an Extension Developer Kit they offer as a free download. But I won’t get into that today!

You can try Moneydance using their free trial, which works a bit differently than the other trials we’ve talked about. There’s no time limit on their trial, but you’re limited to 100 manually entered transactions. Still, that’s enough to decide if Moneydance is for you. After that, you can buy the full program for a one-time fee of $49.99. They also offer a 90-day money back guarantee when you purchase from their website.

8. Banktivity

Banktivityis a personal money manager made for Mac users. The newest version, Banktivity 7, is designed specifically for MacOS Sierra. And – like Moneydance – when you turn to Banktivity as a Quicken replacement, you can import your data for a seamless transition.

With Banktivity, you’ll sync your bank accounts and use it to build budgets, track your spending, pay your bills, and monitor your investments.

They also offer some really cool reporting options. For example, you can generate reports based on category spending or spending at a given merchant. So, if you want to track how much you spend on eating out, you can easily generate a report showing all your spending in that category over a given time frame. Or, if you want to get even more specific, you can easily pull up how much you spent on McDonald’s in the past two weeks.

The “Find” feature in Banktivity is kind of like Mac’s spotlight – it lets you search all your transactions to find the one you’re looking for. This can be a great time saver when you’re trying to quickly check something specific.

Banktivity offers a free 30-day trial, no credit card required. After that, you can purchase the desktop app for a one-time fee of $69.99. You can then download the app on iPhone and iPad and sync across your devices.

9. GoodBudget

GoodBudget is a simple budgeting app that helps you plan and track your spending through a digital version of the envelope method.

If you’re unfamiliar with the envelope method, this is a style of budgeting where you use an envelope for each spending category. First, you’ll plan how much you’ll spend on each category (usually throughout the month). Then, you allocate cash for those expenses in each category’s designated envelope.

Throughout the month, you’ll take money from a designated envelope each time you need to spend in that category. If you run out of money in an envelope, you can’t spend any more on that category… unless you borrow the money from another envelope (which will reduce your spending power in that category).

The free version of GoodBudget gives you twenty envelopes and allows you to download transactions from one bank account. You can also sync across two devices – which is great for using it on desktop and mobile. You can also use one sync to share a budget with your partner.

GoodBudget Plus costs $6 a month or $50 a year. This gives you access to unlimited envelopes and bank account syncing. You can also use the app on five different devices.

Since you’re likely to have more than one account and may both want access on multiple devices, GoodBudget Plus is probably more practical for a couple who shares a budget. That being said, it’s great that this software also has a free option.

10. Dollarbird

Dollarbird is another simple, no-frills budgeting app that makes for a good alternative to Quicken. This app is unique in that it’s calendar-based rather than category-based. What this means is that Dollarbird focuses on tracking your income and spending by day, rather than by category.

So, when you open the app, you’ll see a calendar. From there, you have the option of adding transactions (income or spending) for each day. Although you do categorize your transactions, the app displays your net spending per day rather than a running category total.

At this time, Dollarbird does not support syncing with your online accounts. This means all your transactions must be entered manually. However, you can schedule recurring transactions so you’re not constantly required to enter your regular fixed expenses. If you’re paid a regular salary, you can do the same with your paychecks.

The free version of Dollarbird gives you access to one calendar – perfect if you’re doing a simple solo budget.

The paid Pro version allows up to 20 calendars and can be accessed by three people. Again, the paid option might be more practical for couples. You can opt to pay $3.99 monthly or $39.99 for the year.

11. Everydollar

Next on our list of Quicken alternatives, we have Everydollar. If you’re a Dave Ramsey fan, you may want to give his budgeting tool a try.

I'm getting yellow/red lights in my client! However, if most of the people on the torrent are firewalled, then your speeds are greatly limited to only being connected to those that are not firewalled (and, don't forget that all the other firewalled people may only connect to those that aren't firewalled so the non-firewalled people are forced to send out their data to a lot of people and thus can only upload at a small rate to any one person). Am I firewalled? Fleetwood mac then play on.

Everydollar lets you budget your income into customizable spending categories, then enter your transactions and track your spending. The free version doesn’t link to your online accounts, so you enter your transactions manually. (If you want to automatically sync to your online accounts, you’ll need the paid version.) That’s not a deal breaker, but one thing I’ve noticed is that the app doesn’t seem to remember the category associated with a payee that’s previously been entered. Adding that would be a nice touch.

This is a super simple budgeting app that should meet the needs of someone who wants to get started with planning a budget and tracking their spending. It’s free, so there’s no risk involved in trying it out for a few months to see what you think.

12. PocketGuard

If simple smartphone apps are more your thing, PocketGuard deserves your consideration.

PocketGuard helps you budget your money, track your spending, and lower your bills. Better yet, it is available for both iOS and Android devices.

To get started, simply connect your credit cards, bank accounts, investments, and loans to the app. Your info will sync to the app and update automatically as transactions happen.

Although it’s not as powerful as the best Quicken alternatives, it can certainly help you keep an eye on your finances. Like some of the other programs, this app helps you see the balance of your connected accounts all in one place. It can also help you track and categorize your spending, set monthly income and spending goals, and provide tips on where you can save even more. The “in my pocket” feature even shows the amount of money you’ve got available to spend after accounting for all of your bills and savings goals.

PocketGuard’s main features are free. It’s worth noting, however, that they also offer a paid version called PocketGuard Plus. The upgrade offers significantly more customization (including custom categories, cash transactions, etc.) and costs $3.99/month or $34.99 if you pay annually.

13. MoneyWiz

MoneyWiz is another alternative to Quicken that works with Apple, Android, and Windows devices.

With this app, you can easily sync all of your financial data into one place. It also boasts a live syncing feature which allows you to sync data between devices in real-time.

Using MoneyWiz for budgeting is also a breeze. The app allows you to create different budgeting categories which you can set up as a one time or recurring category. Balances can be rolled over from one period to the next, and the program will even monitor your accounts for transactions – automatically updating the relevant information as you go. You can also transfer money between categories, similar to the “envelope” method.

In addition to the automatic syncing functions on the premium version of the app, MoneyWiz also allows you to enter your transactions manually. It is also capable of creating multiple reports and graphs, including custom financial reports.

So, if you’re looking to replace Quicken, MoneyWiz may be worth a try. While there is a stripped down version that’s free, you can get all the functionality by purchasing the premium version for just $4.99 a month or $49.99 per year.

14. Status Money

Are you competitive about your finances? There’s an app for that.

Status is a free program that allows you to compare your financial situation with your peers. Simply connect your accounts and start comparing right away. Then, use those comparisons as motivation to improve your own financial situation!

Of course, Status is about more than just comparing yourself to others. With Status, you can track your net worth, create spending goals, and monitor your credit. The program also analyzes your saving and spending by category, offering suggestions to improve your situation along the way.

Although Status is not nearly as robust as many of the other options, it is free to use. (It is ad supported, so keep that in mind when considering their suggestions.) So, while it may not be the perfect Quicken replacement, it won’t cost anything for you to test it out.

15. Wally

Wally is another personal finance app available for use on your smartphone. This app focuses entirely on budgeting and tracking your expenses. So, if you’re somebody who needs help with those two things (and who doesn’t?), Wally may be for you!

Although the app is attractive, it isn’t very complex. Unlike almost every other program on this list, with Wally, you won’t connect your accounts. For those who are a little skittish about cloud-based apps, this may actually be seen as a plus.

Effectively, Wally is like using a paper budget…except it’s on your smartphone. You’ll have to manually enter your income and transactions, although you do have the ability to create recurring expenses for bills that stay the same every month.

Even though it lacks automation, Wally does a good job of doing what it sets out to do – help people manage their monthly budgets. Once you set it up, you’ll be able to quickly compare your monthly income to your expenses, helping you to get a firmer grasp on your finances.

Wally was originally available just for iPhones, but they recently unveiled a new version for Android. According to their website, the app is (and always will be) free. There are plans to add some paid features, but we’ll have to wait and see what those are when they are rolled out in the future.

16. GnuCash

GnuCash is a free open-source financial management software that runs on some Windows and Apple operating systems.

The app uses the double-entry accounting method to help you keep track of your finances. Business owners should already be familiar with this concept as it is the preferred method used for balancing books and keeping accurate financial records for companies.

With that said, the app can help with your personal finances as well. Through GnuCash, you can track your bank accounts, income, expenses, and investments. If you’re planning to replace Quicken, you can input your information directly from your old software. GnuCash is also capable of running a variety of financial reports for those who need them.

GnuCash is typically better for those who have a business and isn’t a perfect fit for most people’s personal finances. However, it is free, so it may be worth a try.

Quicken Alternatives: Final Thoughts

With Quicken no longer the only financial tracking game in town, there are plenty of options to choose from. Whether you’re looking for a simple budgeting program or a complete personal finance software package, there’s enough variety on this list to suit almost any need.

Although everybody has their preferences (us included), ultimately, the best financial tools are ones you’ll use consistently. So why wait? Use one of the links above to download a free app or start a free trial to find out what program works for you.

How many of these money management tools have you tried? Which is your favorite? Let us know in the comments!